Fair.org: The 'Raising the Retirement Age' Scam

The 'Raising the Retirement Age' Scam

What they're really talking about doing to Social Security

In the wake of Barack Obama’s re-election, a bipartisan “grand bargain” to reduce the federal budget deficit is on the agenda. It’s inevitable that “raising the retirement age” for Social Security benefits will be talked about by corporate media as an option that would save the government large amounts of money.

Such talk, however, will be entirely misleading—and designed to mislead.

During the 2012 campaign, there were indications that both major party candidates had this option on their radar, and corporate media seemed perfectly pleased. “Mitt Romney, the presumptive Republican presidential nominee, has bravely proposed an increase in the retirement age,” editorialized USA Today (4/27/12):

Gradually raising the retirement age (currently 66 and climbing slowly to 67) for able-bodied workers is the approach that best matches the reason the program is in trouble. Social Security is not bloated or poorly run. Its shortfall is primarily the result of people living longer, and therefore drawing benefits longer.

And when Romney picked Paul Ryan as his partner on the GOP ticket, the Washington Post (8/12/12) voiced its approval of Ryan’s “willingness to tackle third-rail issues,” including “raising the retirement age” for Social Security.

President Barack Obama has been less explicit about his plans for Social Security in his second term, but accepting renomination at the Democratic National Convention (9/6/12), Obama said of the federal budget deficit: “Now, I’m still eager to reach an agreement based on the principles of my bipartisan debt com-mission.... We will keep the promise of Social Security by taking the responsible steps to strengthen it.”

What are those “principles,” set forth by Obama’s hand-picked commission leaders, former Republican Sen. Alan Simpson and Clinton administration staffer Erskine Bowles? As the Brookings Institution’s William Gale explained in a Washington Post piece on “Myths About the Deficit” (11/28/10), “Social Security supporters... have heaped criticism on Bowles and Simpson for their proposal to raise the early and normal retirement ages by one year per generation for the next two generations—even though the average lifespan will probably increase even faster, so retirement periods would still grow.”

In his first debate with Romney (10/3/12), Obama said of his opponent, “I suspect that, on Social Security, we’ve got a somewhat similar position.... It’s going to have to be tweaked the way it was by Ronald Reagan and...Democratic Speaker Tip O’Neill.” The point was glossed by the L.A. Times (10/4/12): “At that time the retirement age was raised modestly and the payroll tax increased significantly.”

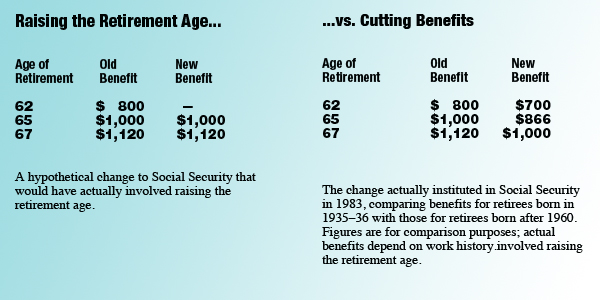

When Reagan and O’Neill “tweaked” Social Security in 1983, they didn’t actually “raise the retirement age”; you could retire at age 62 before, and when their plan is fully phased in in 2022 (barring further “tweaks”), you will still be able to retire at age 62.

The way Social Security benefits work is that the longer you delay getting them, the more you get per month. The Reagan/ O’Neill scheme cuts the benefit that you got at any particular age, so that people who retire at 64 get as much as people who retire at 62 used to get, people who retire at 65 get as much as 63-year-olds used to, and so on. You still reach the maximum retirement benefit by retiring at age 70—but that maximum benefit is smaller than it would have been if you had been born a generation earlier.

This is what they called “raising the retirement age.” There’s a simpler, more understandable and more accurate way to describe it: “cutting Social Security benefits.” You take the amount of money everyone’s going to get, and you reduce it; that’s what “cutting” means.

They don’t describe it that way, of course, because “raising the retirement age” sounds so much more reasonable: People are living longer, aren’t they—so why can’t they retire a little later? You can argue with that, but it’s certainly easier to sell than “old people don’t need so much money, do they?”

It’s likely that a big part of the reason it sounds better to people is that the “retirement age” framing actually makes them misunderstand what’s being proposed. You imagine not getting a couple of years of benefits while you continue to work—you don’t imagine a slice taken out of every check you get for the rest of your life.

Because, really—what is it about living longer that should make people need less money for their retirement?

![]()

This work is licensed by Fair.org under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License.

<< Home